unrealized capital gains tax warren

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Warren says her mark-to-market tax would.

Elizabeth Warren Says Top Irs Auditors Would Make Billionaire Tax Workable Bloomberg

This tax is similar to taxes that have long been supported by progressive lawmakers like Sens.

. An Obama Administration plan to tax capital gains at death would have raised about 200 billion during the 10-year budget window. Actually there is absolutely no way to do what she suggests. The Problems With an Unrealized Capital Gains Tax.

Under Warrens plan dividends would be taxed as ordinary income at 37 percent 148 million face a new Social Security tax 148 percent 59 million and the Net. Biden also called for the top capital gains tax rate to be the same as his top proposed rate on other income at 396. If the proposal were.

Elizabeth Warren D-Mass and Bernie Sanders I-Vt. Answer 1 of 2. Currently taxpayers only pay.

Presidential candidate Elizabeth Warrens tax proposals would push federal rates on billionaires and some multimillionaires above 100 to finance social programs. Elizabeth Warren D-Mass and Ron Wyden D-Ore speak to reporters about a corporate minimum tax plan at the US. Below are one economists estimates of what the top 10 wealthiest.

The value of unrealized gains is based on a snapshot of the underlying asset at a specific point in time. 26 2021 in Washington DC. To increase their effective tax rate.

If you hold an asset for less than one year and sell for a capital gain the difference. When a permanent income tax was. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

The Democrats have stressed that taxes will not be increased on middle- and working-class Americans. A lot of lies being spread about the proposed unrealized capital. Renouncing citizenship already comes with an exit tax to oversimplify on unrealized capital gains on assets above a certain level and there some other levies too but.

An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Senate Finance Committee Chairman Ron Wyden D. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2 trillion social.

Hiltzik Why Elon Musk S Taxes Are Important Los Angeles Times

Is A Wealth Tax A Good Idea Unrealized Capital Gains Tax Explained Youtube

The Meaning Of Income Suddenly Becomes Very Important For Tax Purposes Mish Talk Global Economic Trend Analysis

Moses Kagan On Twitter Tax Free Compounding Of Unrealized Capital Gains Is The Cheat Code Of American Capitalism Twitter

Elizabeth Warren S Wealth Tax Would Hurt More Than Just The Tippy Top

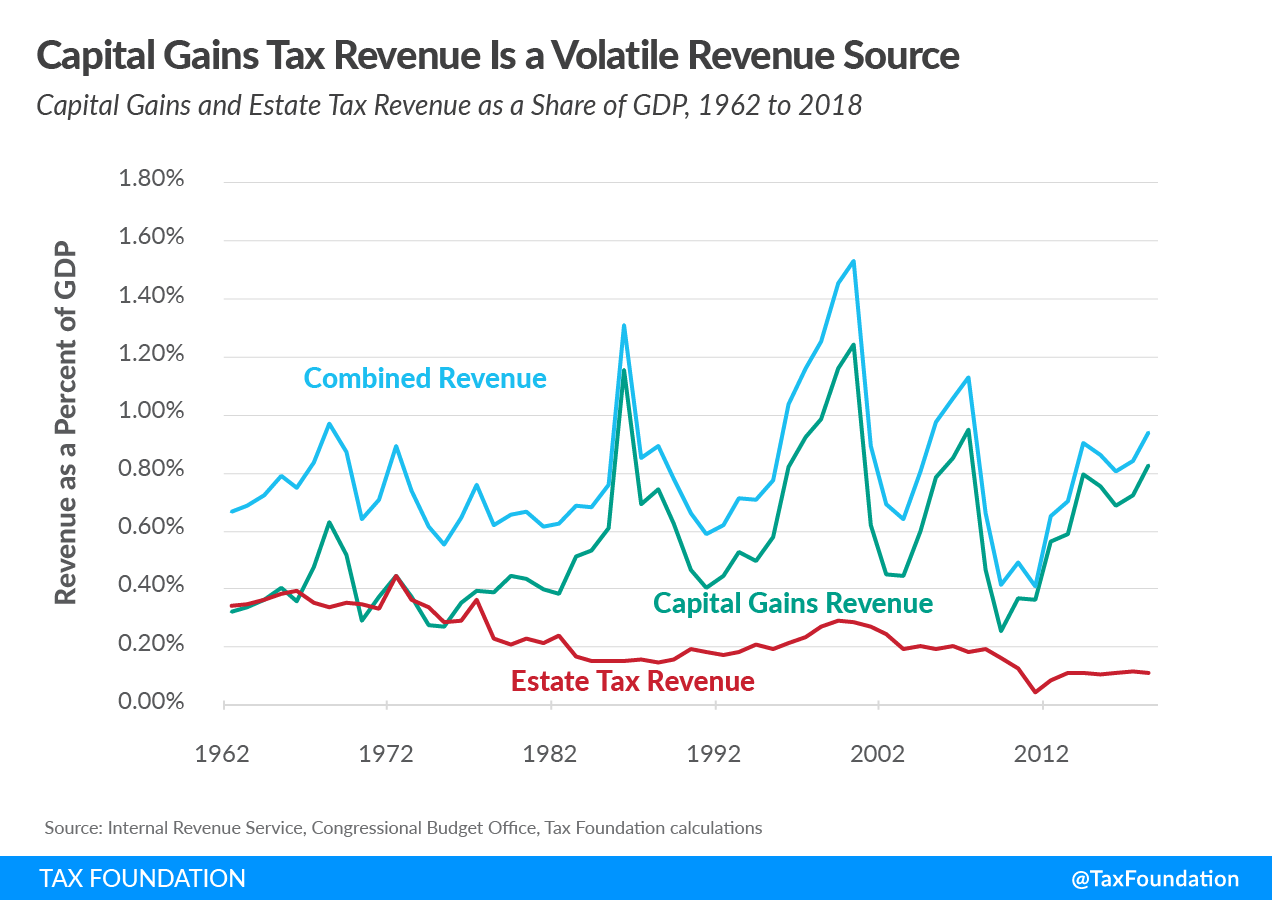

An Overview Of Capital Gains Taxes Tax Foundation

Warren Buffett Taxing Capital Income Is A Bad Idea The Hill

A Broader Tax Base That Closes Loopholes Would Raise More Money Than Plans By Ocasio Cortez And Warren Larry Summers

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Ten Reasons To Be Concerned With Biden S 20 Percent Tax On Unrealized Gains Americans For Tax Reform

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Elizabeth Warren On Twitter Our Tax System Is Badly Broken That S Why Democrats Have A Plan To Raise Taxes On Millionaires And Billionaires The People At The Top Who Are Not Paying

A Fiscal Analysis Of Elizabeth Warren S Medicare For All Plan By Avik Roy Freopp Org

Senator Warren S Nutty Idea To Tax Unrealized Capital Gains International Liberty

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

Billionaire Investor Mark Cuban Slams Elizabeth Warren For Demonizing The Wealthy Fox Business

Senator Warren S Nutty Idea To Tax Unrealized Capital Gains International Liberty